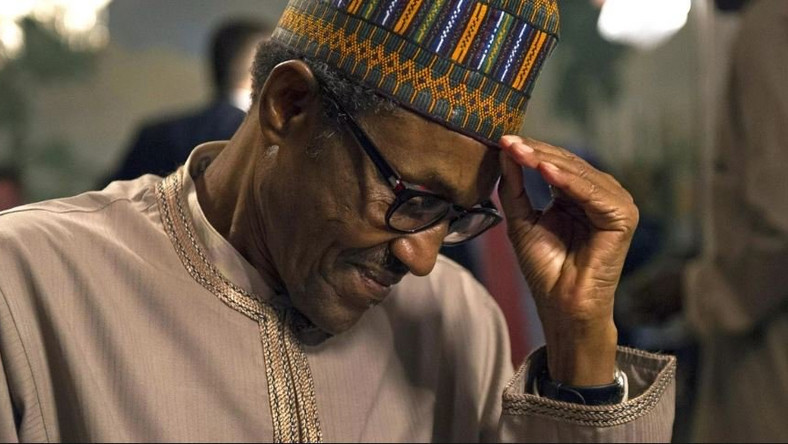

President Muhammadu Buhari said on Wednesday that he was saddened by the Apapa gridlock, especially the toll it had taken on business in the Lagos area.

He spoke during a meeting with the leadership of the Lagos Chamber of Commerce and Industry led by its Chairman, Mr Babatunde Ruwase, in Abuja.

However, he expressed hope in the ongoing efforts by the Federal Government and the Lagos State Government to end the gridlock.

“I must admit the Apapa gridlock still remains a challenge. It saddens me that businesses have had to suffer as a result of this.

“We are doing our very best working with the Lagos State Government to bring an end to this issue,” he said.

The President also briefed the visitors on the investments undertaken by his administration in the last four years on infrastructure development and in support of the business environment, including the establishment of “development banks to provide loans to traders and small enterprises.”

Buhari and the LCCI leadership reviewed Nigeria’s recent signing of the African Continental Free Trade Agreement, both agreeing that there were pros and cons for the country.

Buhari said, “The consultative approach Nigeria took on the Africa Continental Free Trade Agreement is just another example of our desire for sustainable and inclusive growth. The team visited all the geopolitical zones. We met farmers, commodity traders, manufacturers, bankers, and stockbrokers. We listened and made notes of their views.

“Our studies revealed that although the services sector was doing okay, other key jobs creating sectors such as manufacturing and processing were still lagging behind.

“This is evident from the fact that intra-African trade only accounts for 14 percent of Africa’s total trade. As a continent, our consumption is mostly of goods imported from outside the continent.”

The President also said, “We viewed this as both an opportunity and a threat. It is an opportunity as Nigerian manufacturers can aggressively expand to meet the huge demand across the continent. It is a threat as one can abuse the rules of origin to flood the market with imports from outside the continent, thereby destroying jobs here at home.

“Nigeria’s engagement in the next phase of the negotiations is to ensure proper safeguards are put in place to support African manufacturers. We shall continue to count on your support to ensure this goal is achieved.”

On his part, the LCCI’s chairman noted that AfCFTA would promote economic integration in Africa.

He urged the government to speed up the implementation of the agreement by putting necessary measures in place to enable Nigeria to harness its maximum benefits.

Ruwase said, “We commend Your Excellency for signing the AfCFTA. We believe it will promote continental economic integration and growth of member countries. We appreciate in particular the extensive consultation with the private sector which preceded the signing of the agreement.

“We also commend the recent setting up of National Action Committee on the implementation of AfCFTA. We look forward to speedy execution of programmes and projects that will create the environment to enhance the competitiveness of Nigerian businesses within the context of AfCFTA.”

He also spoke on the Apapa gridlock, noting that while it appeared that traffic flow had eased in some areas, the problem was far from being over.